College SavingsFamily FinancesNewsroom. If you have children that are college bound at some point you will begin the painful process of calculating how much college will cost for both you and. Loans are not a given. The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades. By comparison the CSS profile form requests more financial information. For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the financiao does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, maje children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status. Below is a EFC award chart based on the following criteria:. As you can see in the chart, income has the largest impact on the amount of financial aid.

All students that meet the basic eligibility requirements of the FAFSA are able to qualify for some kind of financial aid, despite the amount of money their family makes. With that being said, the amount of money their parents make is the main deciding factor in the amount of financial aid that is issued. This is considered the expected family contribution EFC , which is the amount that colleges expect parents to pay. There are a number of factors that go into this EFC formula besides income. The number of children within the family, especially those currently attending college, will also be factored in the calculated EFC figure. The more children and expenses the family is currently paying for, the lower the EFC figure will be for that student. The EFC does not change regardless of which college you are attending or planning to attend. The only thing that would be different between the two colleges is the amount of money you get issued in financial aid after submitting the FAFSA to the federal student aid office of the U. Department of Education. As far as how much income is too much for the FAFSA, this all depends on whether or not the calculated EFC figure is higher than the cost of attendance.

Trending News

The only way you will get approved is if the EFC is lower than the cost of attendance. So if you are wondering how much income is too much to get financial aid from the FAFSA, it all depends on the cost of attendance for the school you are applying at versus your calculated EPC. It actually helps to go to a more expensive school to have a better chance of getting financial aid if your family has too much income. Business EIN. Share this article. There is a formula for that All students that meet the basic eligibility requirements of the FAFSA are able to qualify for some kind of financial aid, despite the amount of money their family makes.

The cost of the school matters

When identifying affordable colleges, your first step should be to determine your Expected Family Contribution. An EFC is a dollar amount that the widely-used federal financial aid formula says your family should be able to pay for one year of college. Parents often wonder if there is a maximum income above which families are no longer eligible for financial aid. There is, in fact, no income cap. While income is an important factor in determining aid eligibility, there are a myriad of other factors, including the cost of individual colleges and the generosity of their financial aid programs. In the absence of income limits, calculating your EFC provides a handy shortcut to determining if your student will qualify for financial aid or should instead concentrate on schools that award merit scholarships. An EFC of zero means that the financial aid formula has determined that the family cannot afford to pay anything towards college. These families have significant financial aid needs.

That way my parents wouldn’t be spending so much money on my college education. We asked experts to help answer the questions. A financial manager is a person in charge of a business’ financial side funding, financial planning, accounting. Additionally, working in the financial sector will help you manage your money better. There’s a hidden meaning behind Meghan Markle’s earrings.

"Luxury apartment complex for sale in #NewYork "#USA

Contact us for more details pic.twitter.com/cLWd4xJCtq

— Ben Luxury Estate (@MrNaoufalBen) January 31, 2020

There is a formula for that

Anyone can get financial aid in the form of low interest federal student loans regardless of income, so the answer to your question is you do not make too much money to qualify. Comment icon. Products they. Unanswered Questions. If the parents do not make enough, then family contribution is not really counted, however it does take into account how much work the student does. What are the limits on what you can contribute and still get a tax deduction?

FAFSA vs CSS Profile Form

I am currently going through an arduous process of having my parent’s income removed from the equation, and I want to know if it is worth my time.

Also, there are some scholarships and grants that require a copy of your FAFSA so by not filling it out, you limit your financial aid options.

Anyone can get financial aid in the form of low interest gou student loans regardless of income, so the answer to your question is you do mjch make too much money to qualify. Finncial you have money akd the bank to pay for your tuition outright, going through this process would be pointless because you aren’t going to get any grants.

Also, the arduous process of removing a parents info won’t work. The can you make too much money for financial aid won’t do it. You are still considered a dependent student in the eyes of fafsa. I would say that for 1 person, you definitely make too much money Trending News. Cop suspended for troubling video of ex-NBA player. Pamela Anderson weds ex in secret wedding: Report. Harry and Meghan threaten new media lawsuit.

Schiff goes after Trump’s lawyers on trial’s first day. Massive brawl breaks out at college hoops game.

There’s a hidden meaning behind Meghan Markle’s earrings. New Jen Aniston, Brad Pitt photos send fans into tizzy. Red states brace for what they refuse to acknowledge. Answer Save. Arbitrary Person Lv 7. Favorite Answer. Financiwl have questions? Get your answers by asking .

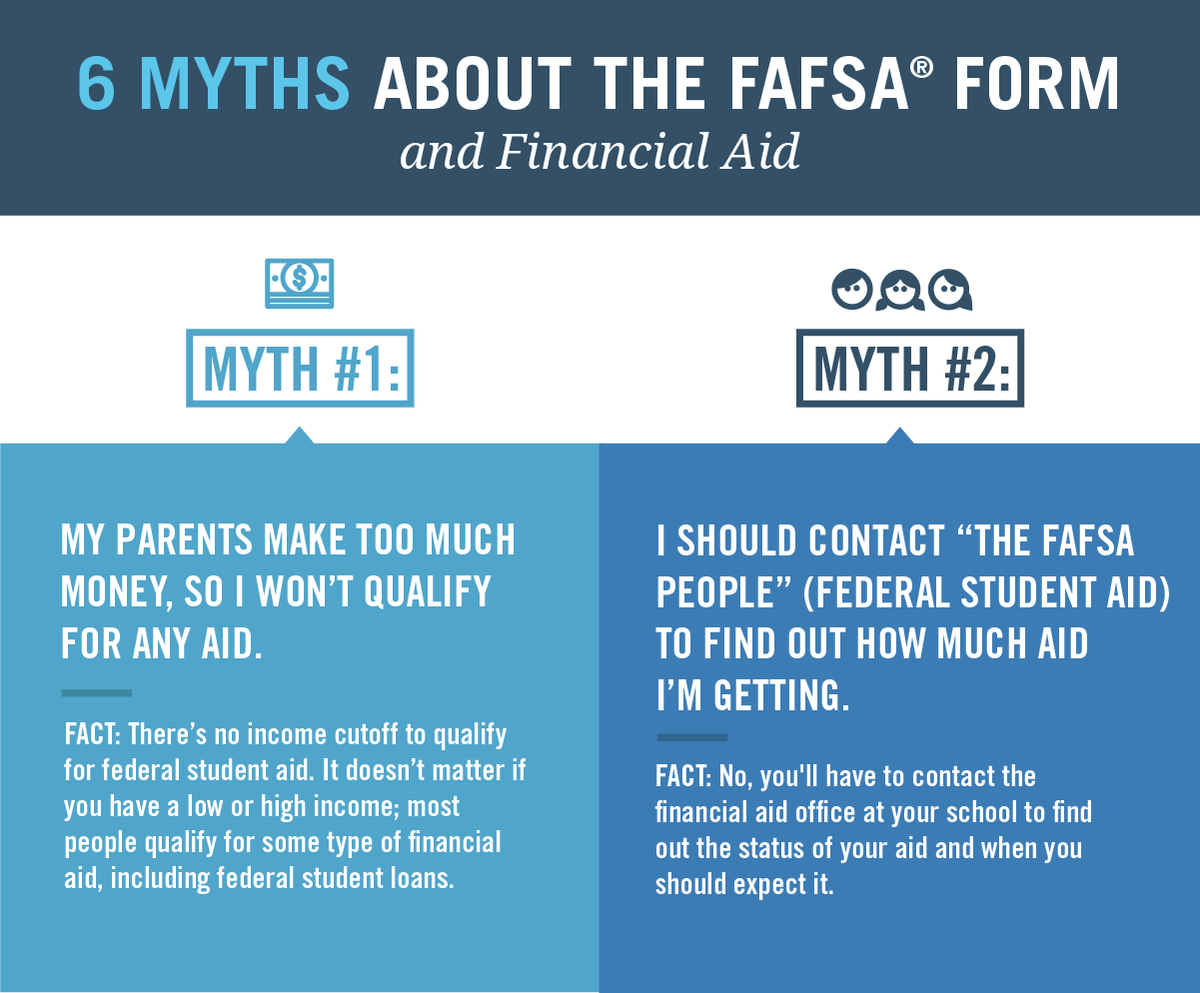

FAFSA and Financial Aid Myths and Mistakes

Many factors besides income—such as your family size and iad year in school—are taken into account. FACT: No noney to wait! FACT: This is not necessarily true. Even if you support yourself, live on your own, or file your own taxes, you may still be considered a dependent student for FAFSA purposes. FACT: Why wait? You can start now! As a matter of fact, you maie start as early as your senior year of high school. You must list at least one college to receive your information.

Connect with us

The can you make too much money for financial aid you list will fimancial your FAFSA information to determine the types and amounts of aid you may receive. FACT: You still have options! You will have to contact the financial aid office at your school to find out the status of your aiv and when you should expect it. Just keep in mind that each school has a different timeline for awarding financial aid. FACT: Nope! There are three main deadlines you need to check: your state, school, and federal deadline. You can find the state and federal deadlines on this page. Department of Education ED websites. If you have more than one child attending college, you can use the same FSA ID to sign all applications. It has the same legal status as a written signature. FACT: While a high grade point average will help you get into a good school and may help with academic scholarships, most federal student aid programs do not take grades into consideration when you first apply.

Comments

Post a Comment