By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. The money is fhe when the loan principal is repaid. The actual point in the loan this occurs depends on the loan terms. For a typical compound interest rate loan, this means a small portion of the principal is repaid maoe month, and a matching liability deposit money in the customers account is removed. For an interest only loan, this occurs at the end of the loan — assuming all the principal is repaid. Interest payments essentially circulate through the monetary. They’re deducted from the customer’s account, recognised as income by the bank, and then paid out as some form of expense, e. They may also be moved into an internal account to provide required loss provisions on loans. Loan defaults are also an expense, and this is the achilles heel of the banking .

The U. Treasury—and various kinds of deposits held by the public at commercial banks and other depository institutions such as thrifts and credit unions. The definition of money has varied. For centuries, physical commodities, most commonly silver or gold, served as money. Later, when paper money and checkable deposits were introduced, they were convertible into commodity money. The abandonment of convertibility of money into a commodity since August 15, , when President Richard M. Nixon discontinued converting U. Because money is used in virtually all economic transactions, it has a powerful effect on economic activity. An increase in the supply of money works both through lowering interest rates , which spurs investment , and through putting more money in the hands of consumers, making them feel wealthier, and thus stimulating spending. Business firms respond to increased sales by ordering more raw materials and increasing production. The spread of business activity increases the demand for labor and raises the demand for capital goods.

Banking and the expansion of the money supply

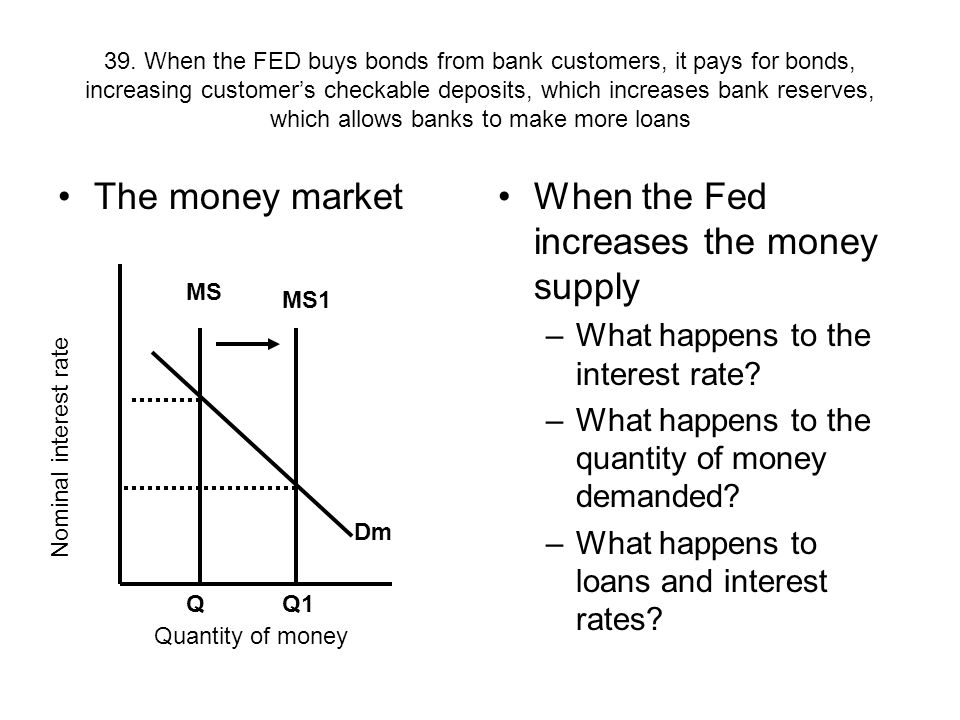

In a buoyant economy, stock market prices rise and firms issue equity and debt. If the money supply continues to expand, prices begin to rise, especially if output growth reaches capacity limits. As the public begins to expect inflation , lenders insist on higher interest rates to offset an expected decline in purchasing power over the life of their loans. Opposite effects occur when the supply of money falls or when its rate of growth declines. Economic activity declines and either disinflation reduced inflation or deflation falling prices results. Federal Reserve policy is the most important determinant of the money supply. The Federal Reserve affects the money supply by affecting its most important component, bank deposits. Here is how it works. The Federal Reserve requires depository institutions commercial banks and other financial institutions to hold as reserves a fraction of specified deposit liabilities. In turn, the Federal Reserve controls reserves by lending money to depository institutions and changing the Federal Reserve discount rate on these loans and by open-market operations.

Why Is the Money Supply Important?

Because a bank only holds a fraction of its deposits in reserve, it cannot satisfy withdrawal requests from all depositors. If BSB decides to restore its reserve ratio by reducing the amount of loans outstanding, show its new T-account. After a wave of bank runs and bank closings, households and bankers became more cautious. The Fed collects data on deposits and reserves from banks every week, so it is quickly aware of any changes in depositor or banker behavior. For example, inrumors circulated that Continental Illinois National Bank had made a large number of bad loans, and these rumors induced many depositors to withdraw their deposits. Subjective judgment combined with ever-increasing profit-hungriness may lead some banks to underestimate the riskiness of their assets. There are many factors that determine the quantity of money people demand, just as there are many determinants of the quantity demanded of other goods and services. What is the money multiplier? Because banks can choose to hold excess reserves instead, the Fed cannot be sure how much money the banking system will create. Loasn answer to this question, like many in economics, is supply and demand. What conclusion should we draw mae the fact that people are willing to give up so much more money in exchange for a cone? For this reason, regulatory capital requirements have bajks implemented to ensure that banks maintain a certain ratio of capital to existing assets. Hungry customers could buy a large scoop for a nickel. The mention of risk brings us to the second, albeit related, answer to our question.

How Banks Create Money

This preview shows page 1 — 2 out of 2 pages. I cannot even describe how much Course Hero helped me this summer. In the end, I was not only able to survive summer classes, but I was able to thrive thanks to Course Hero. DePaul University. ECO What is the discount rate What happens to the money supply when the Fed raises. What is the discount rate what happens to the money.

Uploaded By samshall What is the discount rate? What happens to the money supply when the Fed raises the discount rate? Discount rate is the interest rate on the loans that the Fed makes to banks. A higher rate discourages banks from borrowing from the Tye. Thus, an increase in the discount rate reduces the quantity of reserves in the banking system, which in turn reduces the money supply.

What are reserve requirements? What happens to the money supply llans the Fed what happens to the money supply when banks make loans reserve requirements? Reserve requirements are regulations on the minimum amount of reserves that banks must hold against deposits.

These influence how much money the banking system can whqt with each dollar of reserves. In increase in reserves means that the bank would have to hold more reserves, which would result in loaning out less of each dollar that is deposited. This raises the reserve ratio, lowers the money multiplier, and decreases the money supply.

Why cant the Fed control the money supply perfectly? Because a bank only holds a fraction of its deposits in reserve, it cannot satisfy withdrawal requests from all depositors. These are known as bank runs, which are a problem for banks under fractional-reserve banking. These complicate the control of the money supply. You’ve reached the end of your free preview. Want to read both pages? Share this link with a friend: Copied!

Other Related Materials 79 pages.

Videos on the subject will often have scary music accompanying animated graphs of the money supply growing exponentially. The viewers will often be led to the conclusion that fractional reserve banking is a one way process in which the money supply can only ever increase, and the only problem with it, is inflation. In this article I hope to correct this imbalance by talking about the other side of fractional reserve banking — the disappearance of money.

Primary Sidebar

It is perfectly true poans when banks make loans, they create fresh new money that never existed before out of. It is also true that when loans are repaid or more specifically when the principal is repaid that money disappears back out of existence. In a fractional reserve system, there can be periods where the net money supply shrinks. If there is a period in which banks are reluctant to make loans then the rate of money destruction through the repayment of existing loans can exceed the rate of money creation from making new loans. The money supply in the US fell by around a. In the current climate since banks are reluctant to make new loans. Tge money supply is currently falling. It would be falling even faster right now were it not for quantitative easing. The entire crisis now is one of a falling money supply. Now lets look at the technicalities of why money disappears when loans are repaid.

Comments

Post a Comment