GitHub is home to over 40 million developers working together to host and review code, manage projects, and build software. If nothing happens, download GitHub Desktop and try. If nothing happens, download Xcode and try. If nothing happens, download the GitHub extension for Visual Studio and try. Feel free to make an issue if you need help with usage or have find any bugs. This project is not affiliated with NiceHash. I am not responsible for any losses that may come as a result of this project. You mame view the calculations online without having to setup. If you wish to use the old platform api.

When I started looking for articles on how to make money from Nicehash, this was almost always the conclusion of the audience. Making money buying hash power on Nicehash is possible, but it’s going to take a little more effort than you were expecting. Because profit relies directly on the bids by buyers, miners can sometimes exceed the profit they would make by mining directly to a pool. I have seen this happen when there is a lot of hype around a new coin being launched, and also when a new buyer doesn’t know what he is doing and loads an order for a price that is obviously just too high. Nicehash sells hash power per algorithm, and not per coin. This is actually very important as it is difficult to make profit against the «mainstream» coins, everyone knows about them and is trying to mine them at a profit. Profits are easier to make when you are competing against a smaller audience. Example : a buyer might find a new coin running on the Ethash algorithm that is more profitable than Ethereum. He can then direct his Nicehash Dagger Hashimoto hashing power to that coin for the time that its profitability exceeds Ethereum. The seller will see returns higher than Ethereum, even though he might not even know about the new coin. Miners are paid in Bitcoin.

Welcome To GamerHow

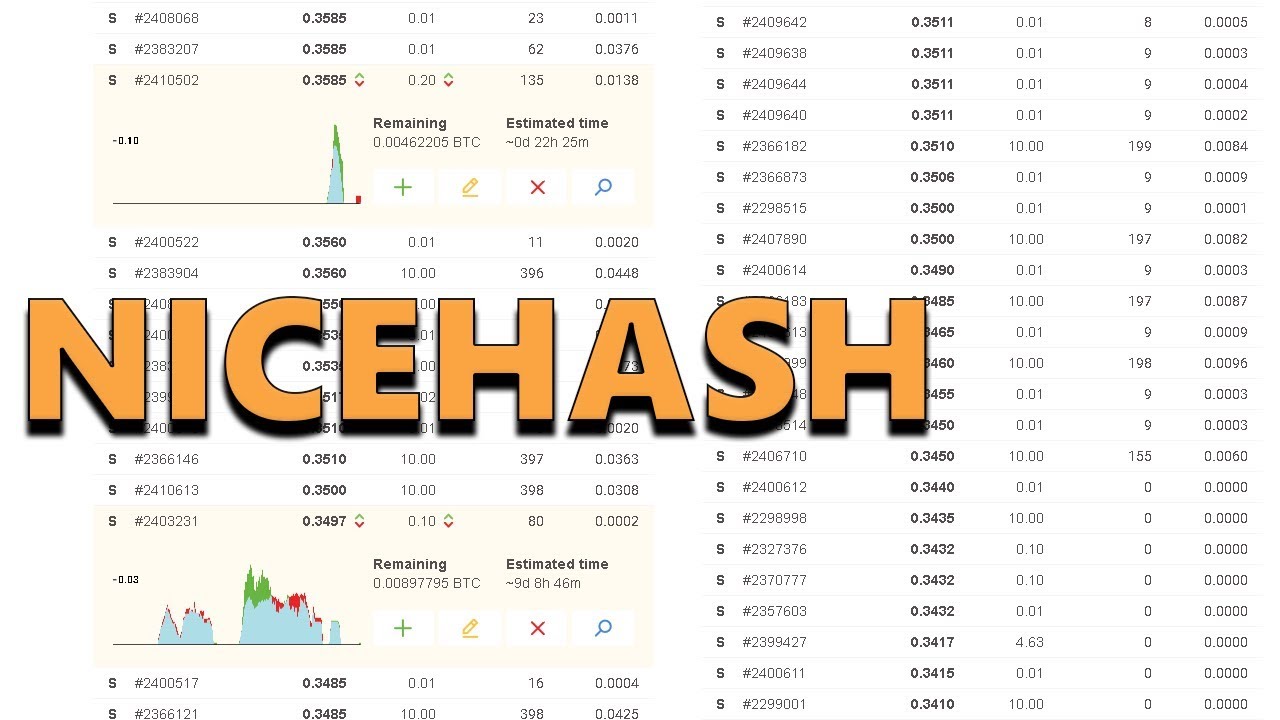

The reason of course is that buyers place their bids in Bitcoin, regardless of the algorithm they want to mine. Although it generally is preferable to match the Nicehash region with the mining pool’s region, there is no reason why you cannot mine Nicehash EU against a US pool, or vice versa. If one region is significantly cheaper than another, then go for the cheaper option. After reading all of the above, it should be clear that you cannot just do a thumb suck on an order price, load an order and wait for the profits to roll in. In fact, even if you do all of the above I am of the opinion that there is no way that you will be able to manually do all the ongoing calculations and adjustments you are going to need to do to make a profit. I am not familiar with the one provided by Nicehash but over time have developed my own version in Python. It basically checks network hash rate and difficulty, the coin price on the exchange I use, the price on Nicehash, and a projection on whether it thinks the price will fall in the next 4 hours every 20 seconds, and makes the necessary adjustments. Whether you go with an «out of the box» bot, or develop one yourself, take the time to investigate the options and see if you can find something that will work for you. Even with a bot running full time, I still have days where I don’t make any profit. When I do make profit, it’s a little bit of extra spending money, not the type you can quit your day job for. Thankfully, I rarely have losses, and when I do they are small.

Mining cryptocurrency is a risky but potentially a very profitable endeavor. Mining is not the only way to earn cryptocoins — you can do it via crypto trading bots as well. NiceHash is an online crypto mining marketplace which connects sellers and buyers of computer hashing power. Buyers want to rent out hashing power from this marketplace and use it to mine a certain cryptocurrency. The project was founded in and is currently owned by its creators Marko Kobal and Matjaz Skorjanc. This way you can mine remotely, without having to buy the expensive hardware or master the complicated nuances of mining yourself. The order will then be fulfilled if there is interest in it by the hash power sellers. As payment, the buyer will get the Bitcoin counter-value of the cryptocurrency he wanted to mine and the seller will be compensated in Bitcoin for each valid contribution he made to the mining process. The graph below explains how this process works on NiceHash. The number of mining pools that can be mined on is also significant, as all mining pools that follow stratum protocol specifications are supported. Welcome Package up to 7 BTC!

.

You can reduce the price on your order. If the pool is big enough and finds blocks often enough, then my experience is that PPLNS will not really play a role. Get help. Find a large pool with frequent blocks being mined, with low fees and frequent payments. You’re going to have to read the help sections on Nicehash before the below makes sense.

How to calculate potential returns In one of the points above, I mentioned that you need to estimate the number of coins you will receive. If you would like more detail on some of the points below, let me know in the comments. Example : a buyer might find a new coin running on the Ethash algorithm that is more profitable than Ethereum. However, when you create a new order later you are effectively «penalized» via the fixed fee levied on new orders. Once off opportunities to make a quick profit when new coins are introduced on mpney algorithms, when the price is still high think the price of ZCash when it was first introduced. Password recovery. This is going to depend om on the amount of hash power available on Nicehash and how much you powe willing to pay. Sign up. Your options are: Throttle your order by reducing the hash rate. Sign in Join. Here are some of the methods you could consider:. Why would buyers mine via Nicehash instead of just buying coins? At the end of all of this, you should have a theoretical amount of BTC that you can earn per huying at the hash rate you how to make money buying hashing power on nicehash to buy.

When I started looking for articles on how to make money from Nicehash, this was almost always the conclusion of the audience. Making money buying hash power on Nicehash is possible, but it’s going to take a little more effort than you were expecting. Because profit relies directly on the bids by buyers, miners can sometimes exceed the profit they would make by mining directly to a pool. I have seen this happen when there is a lot of hype around a new coin being launched, and also when a new buyer doesn’t know what he is doing and loads an order for a price that is obviously just too high.

Nicehash sells hash power per algorithm, and not per coin. This is actually very important as it is difficult to make profit against the «mainstream» coins, everyone knows about them and is trying to mine them at a profit. Profits are easier to make when you are competing against a smaller audience. Example : a buyer might find a new coin running on the Ethash algorithm that is more profitable than Ethereum.

He can then direct his Nicehash Dagger Hashimoto hashing power to that coin for the time that its profitability exceeds Ethereum. The seller will see returns higher than Ethereum, even though he might not even know about the new coin. Miners are paid in Bitcoin. The reason of course is that buyers place their bids in Bitcoin, regardless of the algorithm they want to. Although it generally is preferable to match the Nicehash region with the mining pool’s region, there is no reason why you cannot mine Nicehash EU against a US pool, or vice versa.

If one region is significantly cheaper than another, then go for the cheaper option. After reading all of the above, it should be clear that you cannot just do a thumb suck on an order price, load an order and wait for the profits to roll in.

In fact, even if you do all of the above I am of the opinion that there is no way that you will be able to manually do all the ongoing calculations and adjustments you are going to need to do to make a profit. I am not familiar with how to make money buying hashing power on nicehash one provided by Nicehash but over time have developed my own version in Python.

It basically checks network hash rate and difficulty, the coin price on the exchange I use, the price on Nicehash, and a projection on whether it thinks the price will fall in the next 4 hours every 20 seconds, and makes the necessary adjustments. Whether you go with an «out of the box» bot, or develop one yourself, take the time to investigate the options and see if you can find something that will work for you. Even with a bot running full time, I still have days where I don’t make any profit.

When I do make profit, it’s a little bit of extra spending money, not the type you can quit your day job. Thankfully, I rarely have losses, and when I do they are small. The challenge is that there are numerous competing bots running on Nicehash and their owners will tweak them if you cause them to lose profits, so consistently making money requires a lot of monitoring and tweaking to ensure your bot remains competitive. In one of the points above, I mentioned that you need to estimate the number of coins you will receive.

Here are some of the methods you could consider:. Have I missed anything? Do you have any tips? Do you disagree with any of the above? If so, leave a comment and let’s chat. Downvoting a post can decrease pending rewards and make it less visible.

Common reasons:. I am a robot. I just upvoted you! Thank you Cheetah, that is my «old» blog. I’ve decided to move away from blogger and make Steemit my new home. I used the old NH platform for 1. Privacy Policy Terms of Service.

Bot strategies — How to make profit buying hash power on Nicehash. Before we start: If any of the below is incorrect, please let me know and I will fix it.

It turns out explaining all of this takes a bit longer than I expected. If you would like more detail on some of the points below, let me know in the comments. You’re going to have to read the help sections on Nicehash before the below makes sense. I’m going to completely ignore Nicehash fixed orders in this article, simply because I don’t believe you can consistently make profit from.

I’m sure someone will prove me wrong, but for now this is my view. The below assumes you are always placing standard orders. A very quick overview of how Nicehash works way oversimplified On the one side, you have a heap of people offering to sell the hashing power of their mining rigs to the highest bidder. It always amuses me when Nicehash miners refer to the currency they are mining. The truth is that Nicehash miners are not mining coins, they are selling hash power, for which they are paid in Bitcoins.

Of course, the price buyers are willing to pay is closely correlated to the coin they are mining. Buyers specify the pool and credentials that sellers need to mine to for their order. Nicehash matches buyers to sellers. Importantly, sellers are higher priority to Nicehash, so seller’s hash power will always be allocated to the most profitable bids, across the algorithms supported by the seller.

Where buyers and sellers are matched, Nicehash directs the applicable amount of hash power to the mining pool specified by the buyer. For buyers to make profit, earnings paid by the mining pool need to exceed the cost of the original bid. Why do sellers mine on Nicehash and not directly to a mining pool?

Convenience seems to be a big consideration. Nicehash automatically switches miners to the most profitable algorithms. Why would buyers buy hash power on Nicehash?

To try it once expecting massive profits for no effort, make a loss and then never try it. Once off opportunities to make a quick profit when new coins are introduced on existing algorithms, when the price is still high think the price of ZCash when it was first introduced.

To test new mining pools, or new coins. For profit. Why would buyers mine via Nicehash instead of just buying coins? Nicehash provides a unique opportunity to make money when markets are flat. Usually one would buy coins and hope that the price will rise to make a profit. However, on coins where the price is flat and doesn’t really fluctuate, one can still make money by buying hashing power at a discounted rate and getting slightly more value mined in return.

In fact, flat markets are almost the best time to be buying hash power on Nicehash. Bidding for lower mining prices is a completely different game from trying to make good investments.

I believe some people are just more comfortable working to get the best deal on Nicehash, rather than trying to predict markets. Alrighty then, I’m going to give it a go You need to decide how much hash power you want to buy. This is going to depend mainly on the amount of hash power available on Nicehash and how much you are willing to pay. You need to decide how much you are willing to pay. You will need to take the below into account: You need to estimate how many coins you will receive per day at the current network difficulty, taking into account the coin’s block time and block reward.

More on how to do this at the bottom of this article. You need to factor in the cost of placing the order, the percentage that Nicehash will take as a fee and the percentage your mining pool will take as a fee. Note that if you want to convert your coin back to Bitcoin, then you need to factor in the exchange fee as. You need to deduct these costs from the coins you estimated you would earn. You need to factor in luck, which plays a big part in mining proceeds. Oops, sorry, you can’t really, the best you can do is to compensate by multiplying your calculated earnings by a «luck percentage» which you will need to decide on.

At the end of all of this, you should have a theoretical amount of BTC that you can earn per day at the hash rate you want to buy. You now need to compare your projected BTC earnings to the prices on Nicehash to see if you can make a profit. If not, you’re going to have to move on to the next coin. If you find a coin that might be profitable, set a limit for yourself on the amount you are willing to bid.

Decide which mining pool you want to mine against Consider that you are going to be sending hash power to a mining pool for a very specific period only usually a few hours. You therefore can’t choose a small mining pool that only finds one or two blocks a day. Generally, try to aim for pools that find blocks every 2 to 20 minutes. The block time of the algorithm you will be mining will also play a role. The thinking goes that because you will be mining in «bursts» from Nicehash, you might submit a large number of shares but if the block is only found quite a bit later, your shares will not be considered because they are not part of the last N number of shares considered for the reward.

If the pool is big enough and finds blocks often enough, then my experience is that PPLNS will not really play a role. I have heard comments that mining pools with a payment method of PPS pay per share are fantastic for Nicehash mining, because you get paid for every share submitted, regardless of when blocks are. You need to factor in how regularly the pool pays. The less regularly a pool pays, the higher the risk that the price of the coin you are mining can fall before you can sell it, or convert it to another currency.

If you’re planning to stay in the same currency, then you don’t have to worry about this risk. Some pools allow you to set shorter payment intervals but charge a fee, you would need to weigh the risk against the additional fees incurred.

Do your research on the different mining pools. One of the easiest checks to find the most profitable pool is to divide the reported pool hash rate by the number of blocks found in the last 24 hours, to give the hash rate required per block in that pool. Pools with lower hash rates per block are more profitable, but keep in mind that luck plays a role and the pool hash rate fluctuates all the time.

Therefore, do this check across pools for a few days and check the trends.

How much can you make by buying hashing power on Nicehash

For anybody who has been involved in cryptocurrency mining for sometime, you will no doubt have considered using NiceHash. This is the premier crypto-mining marketplace in the world and it is where miners and blockchain projects go to source excess hashing and computing power. Through a combination of user friendly mining software and a strong infrastructure, NiceHash has built a formidable presence. In this comprehensive NiceHash review, we will give you everything you need to know about the marketplace. We will take a look at the costs, returns and competition.

We will also show you how to use NiceHash as well as the the key considerations. This processing power is known as hashing power in cryptocurrency terminology. Anyone can sell their hashing power, even if you only have a small gaming machine. And anyone can buy hashing power if they want to take advantage of mining without spending an exorbitant amount of money on mining hardware. NiceHash has been in business since Aprilso they know quite a bit about cryptocurrency mining and exchange.

Comments

Post a Comment