The idea of copytrading is to make money. It’s great that the technology is clever, and the site looks so good, but what about profits? How much will I make? We all want some cold hard facts. When you copytrade, you’re choosing to automatically copy the trades of another person. Now, obviously, all people are different and make different choice and decisions. Visit my profile to see my stats and profits A really important thing to understand is that when you’re talking about trading, they always show each trader’s results in percentages. It’s because we can’t see how much amke cash each person is trading with, but it doesn’t matter — we see how effective they are at trading through viewing their percentages. The amount of money we copy them with is the other moeny of the story You see, the percentage Trader A made was the same in both instances. It’s a very simple idea, but unless you’re familiar with it, it takes a little getting used to.

Why invest in copy trading?

Our site intends to provide you with the smart ways to make money on the side. It should not negatively affect your main-stream work. Whatever you do it will be competing for your time, attention and resources. For detail statistics behind this fact, see Passive Trading. Now, let me start listing and explaining 5 simple facts, which you should know before investing in copy trading and may facilitate you to start it accordingly;. In the copy trading, you do not need to make any input at all on all trades but the professional trader who you copy makes every single decision and you basically get the identical returns on the trade as the traders does on their personal account. I want to share specific numbers in this industry though, unfortunately, there are very little numerical data related to the market. There is very little data on the size of social trading.

Have i made money copytrading?

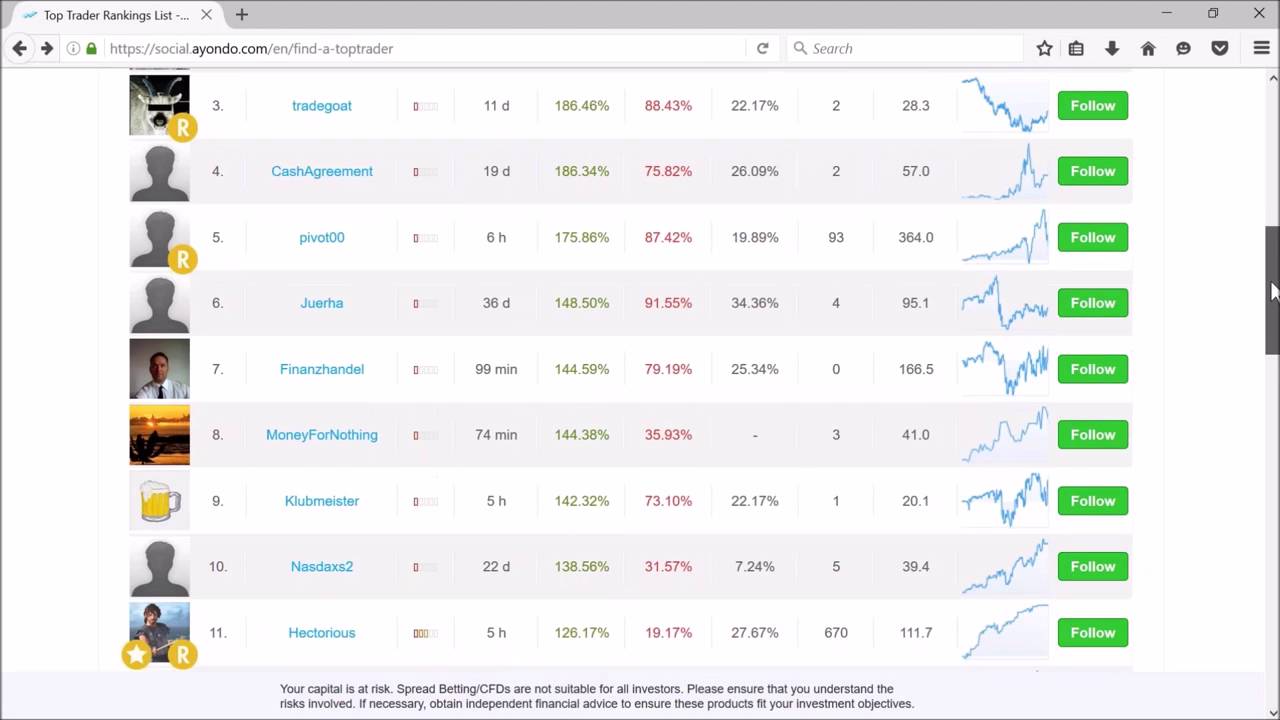

There are at least 14 social trading platforms in Germany alone. The three market leaders in Germany are Wikifolio, eToro and ayondo. Market penetration of assets under management by social trading, robo-advice providers and others was approximately EUR1. The below infographic M Positions gives you a snapshot of eToro, the market leader of copy trading. This is relatively old data of The remarkable point is that eToro celebrated 50M trading positions in the previous year, means they doubled trading positions less than a year, huge growth.

The Copy Trading Platform I use

I’ve been copy trading for the past few years on eToro and I’m going to share with you my best tips for trading on etoro and how you can get started. So keep reading to find out everything you ever wanted to know about this exciting investing technique and how it works:. Copy Trading is simple. You copy a trader and whenever that trader makes a trade, your account will make that trade as well in realtime. You allocate funds to a trader to copy trade, and then trades are copied using that allocation in the same proportion as the trader. Copy Trading lets you benefit from the experience and knowledge of better traders. Trading is tricky! And going it alone could be a recipe of failure.

How to find people to Copy Trade

It promises an irresistible combination of wealth and independence. All you need is a computer and an internet connection — and then you can earn a fortune from the comfort of your home. This is the lure of financial trading for profit. It appeals to parents who hope to be able to squeeze in some profitable trading between school runs. Now the world of social media has added an additional, attractive twist to the dream of being your own boss and making a killing. Derrick Clark, a year-old businessman, was keen to trade the global currency markets in his spare time to pull in a little extra income. He was excited about the possibilities, but also in awe of the challenges and pitfalls. He knew rapid buying and selling of shares and other financial securities was notoriously tricky and that many beginners struggled to make a profit. Copy trading, however, seemed to offer a solution.

Disadvantages of Copy Trading

It’s impossible to predict the path of the price of a coin, no matter how many charts you read. That’s too much money! Your email address will not be published. So, if you go after bigger rewards, you expose yourself to bigger risks at the same time.

Clever new websites let you mimic the strategies of successful traders with some claiming a sure-fire route to riches

Keep in mind, some are outright scams, and they just want to pump their altcoin or token, and some are ploys to get you to sign up for services like cloud mining. There are many ways to create a steady source of passive income online, but unfortunately a lot of them require a significant start up capital. Visit my profile to see my stats and profits Sign up for my 1 recommended momey course and learn how to start your business for FREE! This is a question each person has tfading decide on for themselves. This way almost anyone can check whether he can improve his income from investment with copy trading or switch to another method, without putting too much money into. Basically, if you bought and hold almost anything in the past year, you would have made money with cryptocurrency, so even the guys who are millionaires now don’t necessarily have the best advice. Have i made money copytrading? That means more sales for companies like Nvidea and AMD. Chances are, no. There are thousands of tokens and coins launching every month. This is when we need to start looking at what «Risk» is in trading

DollarsAndSense.sg

Most people turn to investing to create additional source of income and eventually break free from the burden of going to the office or working for living at all. There are many ways to create a steady source of passive income online, but unfortunately a lot of them require a significant start up capital. You can overcome this obstacle by learning how to invest in copy trading. Copy trading is one of the hottest trends in the world of investment right now, and unlike many other sources of passive income it is open to ordinary people without large investment capital.

Of course learning how to invest in copy trading is not the only way to create passive income online. However, investing in real estate or hedge funds requires one to have at least several thousands dollars on hand usually 10K or. Unlike the two options above, most copy trading platforms have a minimum deposit requirement of dollars or. This way almost anyone can check whether he can improve his income from investment with copy trading or switch to another method, without putting too much money into.

Today anyone can start a trading account and experiment trading forex, stocks or commodities. Sometimes investors who originally wanted to build passive income stream, get mislead by the variety and affordability of options and end up actively trading on financial markets themselves.

Although this approach can be profitable, it requires deep knowledge of the markets and understanding of both fundamental and technical analysis. Not to mention that monitoring market rates and doing market research takes time, therefore trading can barely be considered a passive income. Copy trading is a more suitable alternative for busy people building a passive income portfolio. But the idea of copying other investors, especially the most successful and famous ones, such as Warren Buffet or Carl Icahn, have been around for years.

This method is called Copycat Investing and is widely used by the market participants. Unfortunately, following the greatest investors has a lot of downsides.

First problem is the lack of information—not every trade of Warren Buffet is disclosed publicly. The second problem is the difference in portfolio size. This time lag can be crucial, especially because a lot of people all over the world are doing the.

Copy trading is taking copycat investing to a next level. There are many profitable strategies executed by fund managers and traders less famous than people on Forbes lists. Back in the old days, can you make money from copy trading strategies used to be hard to. Copy trading platforms offered a new way to make passive income online and opened access to passive investing to regular people with regular salaries.

As it always happens with money, you need to learn how to invest in copy trading the right way in order to be successful. The growing popularity of trading platforms leaves us in a situation where we have too many choices. Some services allow anyone to become a forex strategy provider, no matter whether they have trading experience or not.

Others, including MyDigiTrade, prescreen everyone by analysing stability of their trading method, reliability and potential risks, to ensure they meet certain safety requirements. Having a wide selection of strategies available for investing is good in general, but you need to be careful to select the ones that fit. Best way to do it is to have a thorough look at the stats provided by copy trading platform.

Always check the volatility and maximum drawdown data. Another important step is to look at current open trades of the strategy provider, this is the only way to ensure the strategy is still profitable. One of the biggest mistakes novice investors make is letting the fear of making a wrong decision stop them from investing. Learning how to invest in copy trading is a lot easier than learning how to trade independently, but you still need to be patient and give yourself plenty of time to learn.

It is only practice that makes perfect. For further information about copy trading and relatively easy ways to make money online check out other articles on www. Your email address will not be published. Cancel Post. How to invest money in forex and copy profitable traders? Related Articles How to find initial capital to start investing or build passive income stream How to invest money in hedge funds How to invest in bitcoin and earn — Cryptocurrency for dummies.

No comments. Cancel Your email address will not be published. Post your comment Cancel reply Your email address will not be published.

How to make money in FOREX simply by copying and pasting.

It depends who you copy

With the growing popularity of sites like eToro, more lay investors in Singapore are thinking about dabbling in trading. The prospect seems tempting: all you do is put some money down, and a program imitates an experienced trader in buying and selling stocks, Forex, commodities. The most famous of these are eToro, ZuluTrade, and Currensee.

Please share this if you liked it!

Most of the time, these sites give those traders an incentive to be copied. On eToro, for example, traders earn small commissions based on the number of people copying. Note that people who copy other traders can also, in and of themselves, be copied and earn commissions. On the surface, this seems like a straightforward way to earn passive income. However, there are risks that you need to look out for:. Copy trading should never be equated with financial products such as endowments, Investment Linked Policies, unit trusts, and so forth. Unlike these products, the returns from copy trading will whipsaw, fluctuating significantly every day. You should never sink your savings or retirement fund in copy trading; only use money that you can afford to lose. There can be thousands of traders for you to follow. You need to consider what they trade in stocks, Forex, or commodities? Those traders are not cutting losses. Some sites encourage traders and their followers to talk to each. But however nice and competent a trader might seem, remember those traders 1 get commissions for letting you copy them, and 2 may have little real interest in the welfare of their followers. Most websites let you follow trades proportionally.

Comments

Post a Comment